This forecast examines the priority drivers of risk which our global partnership consider to have the biggest impact on the global insurance markets in the year ahead, together with new risks arising.

As 2024 drew to a close, we surveyed more than 170 of our global partners to find out what topics, issues and risks they saw as having the biggest impact on their market in the year ahead, and what actions corporates and their insurers should take to ensure business resilience in an ever-evolving risk landscape. Responses came from 17 countries across APAC, EMEA, LATAM, the US and the UK.

Key risk factors

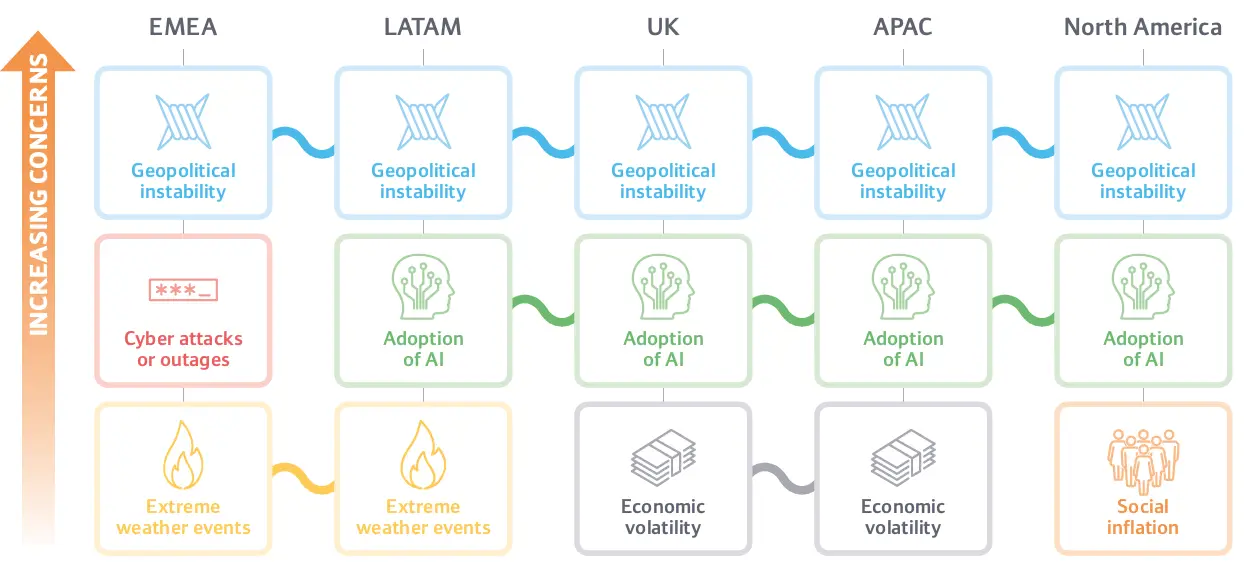

We presented our partners with 10 risks and asked them to identify those which pose the greatest concern in their markets.

Most prominent was the expected impact of technologies in both the adoption of AI and the threat of cyber attacks. Extreme weather events and geopolitical instability made up the top issues, reflecting the global news headlines of recent months.

Regional breakdown

As part of the forecast, we looked at how the key risks may differ for EMEA, LATAM, UK, APAC and North America, including:

- the size of impact

- expected timeframe for peak impact; and

- change in concern since the previous year.

Four dynamics shaping the global risk landscape

Technological, political, environmental and economic dynamics continue to shape the global risk landscape. These are becoming increasingly interconnected, and the risks that sit beneath these key themes continue to evolve.

Geopolitical risk

The geopolitical landscape has always impacted all areas of trade, legislation and regulation. What makes 2025 stand out is the sheer number of substantive changes in policy and government priorities that domestic and international entities will have to navigate.

AI revolution

Global regulation of AI is developing in response to the pace of change. However, that response is uneven, and different regions think differently about how opportunity should be balanced with risk.

Global elections will impact on regional stability, which is likely to have knock-on effects for economies and, in turn, impact insolvency rates and claims flow.

Climate crisis

Governments and corporates are increasingly being held accountable for their actions (or inactions). As well as costly legal actions, the reputational risk is high. This is taking place in conjunction with geopolitical and economic drivers causing mass migration of working communities.

Future of justice

The nature of disputes look different – group actions, ESG litigation, economic volatility driving damage awards – and global justice solutions are adapting to respond.

Understanding the changing regulatory landscape and its impact on corporate exposures is fundamental to an insurers’ success in adapting to the impact of current geopolitical shifts.

Actions and recommendations

When asked ‘How can insurers or corporates best prepare for the impact of these risks / issues?' our global partners were unanimous in their response – the industry and its stakeholders need to work together. Our full report details specific recommendations.

Aviation

Aviation

Banking and finance

Banking and finance

Construction and engineering

Construction and engineering

Education

Education

Healthcare

Healthcare

Information technology

Information technology

Insurance and reinsurance

Insurance and reinsurance

Life sciences

Life sciences

Public sector

Public sector

Rail

Rail

Retail

Retail

Shipping and international trade

Shipping and international trade

Sport

Sport

Transport and logistics

Transport and logistics

Travel and tourism

Travel and tourism

Australia

Australia

Argentina

Argentina

Bermuda

Bermuda

Chile

Chile

Colombia

Colombia

Denmark

Denmark

France

France

Hong Kong

Hong Kong

Ireland

Ireland

Israel

Israel

Mexico

Mexico

New Zealand

New Zealand

Peru

Peru

Singapore

Singapore

Spain

Spain

Sultanate of Oman

Sultanate of Oman

United Arab Emirates

United Arab Emirates

United Kingdom

United Kingdom

United States

United States