The traditional model of operating a claimant personal injury law firm has long gone. Squeezed margins as a result of the fixed costs changes have impacted profit margins and, therefore, the viability of a number of claimant law firms. Across the claims landscape we have seen examples of layering – both in damages and costs - by some firms as they look for other ways to replace revenue.

Such examples include outsourcing parts of the solicitor service and reclaiming this cost as disbursements. Alternatively, there will be additional services, such as rehabilitation treatment, provided to the claimant, with these costs becoming part of the claim.

Increasingly these outsourced companies are closely linked to the law firm (often through shared ownership).

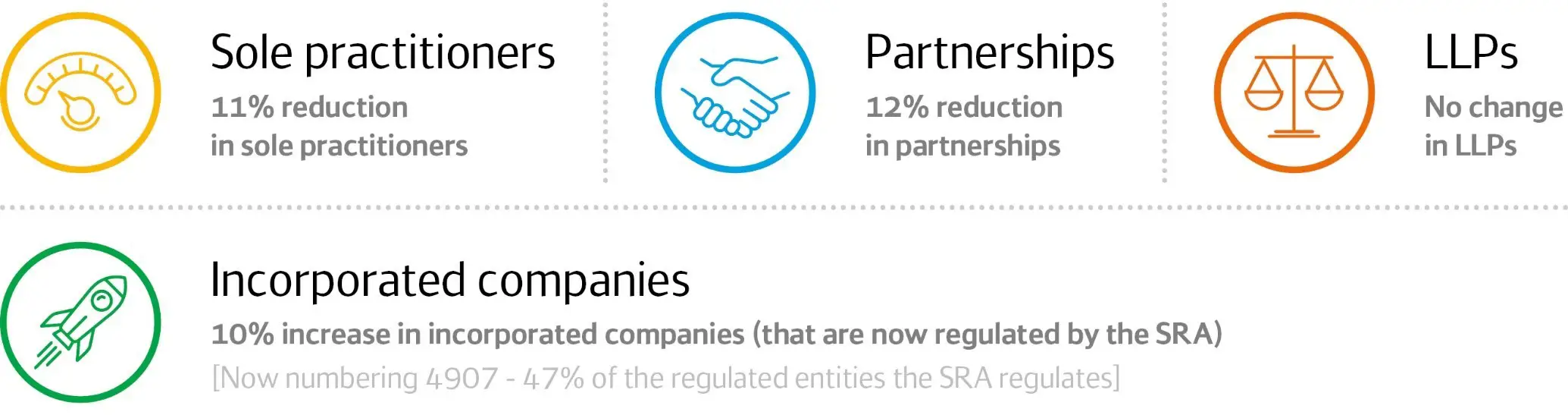

According to figures published by the Solicitors Regulation Authority (SRA), there has been an 11% and 12% reduction in sole practitioners and partnerships respectively, from July 2017 to July 2019. The number of LLPs has stayed around the same. Interestingly, there has been a 10% increase in incorporated companies that are now regulated by the SRA to 4907 since July 2017, they now account for 47% of the entities the SRA regulates.

Claimant personal injury firms are also diversifying into new types of claims which can be pursued in volume outside of the fixed recoverable costs. These are now a hot topic and driving increased claims farming activity in these new areas. We recently covered this in part 4 of our 'future of fraud' series.

Some of these new types of claims can be more complex in nature, and therefore are more difficult to pursue compared to the more standard low value personal injury claim.

This complexity includes less familiar (and less certain) issues such as policy coverage (and therefore insurer interest) and new areas of legal duties (which must be breached in order to give rise to a claim). As a consequence, more time investment is needed in these cases without a guarantee that the claim will be viable. This effort creates ‘work in progress’ (WIP) for the law firm and may also require financial outlays for experts and other disbursements. For an unproven new tranche of work, this is costly and risky.

Many law firms are now turning to litigation funding as a way to fund this initial effort and, in doing so, reduce the risk. Unlocking that WIP will also help with cash flow.

The number of litigation funders coming to market is increasing. Typically they cover the costs associated with bringing a claim, or even a portfolio of claims. There are a range of funding options to suit almost any scenario. The funder can make their return in a number of ways:

- Taking a percentage of the profit costs.

- Charging interest on the ‘loan’.

- Acquiring an interest share in the claimant’s damages.

Litigation funding is enabling new market entrants in an already saturated claimant market. They can be focused purely on one claim type and fed by one referral source. We have seen this in relation to travel sickness and cavity wall claims.

Some firms are now receiving funding for their claims/WIP upfront with various triggers to release payment such as claim presentation to defendant/insurer. It is easy to see how arrangements like this feed claims surges and the problems (such as fraud) from farmed claims. There is little incentive for the claimant solicitor to properly assess the veracity and merits of the claims being presented.

The apparent ease at which litigation funding can be obtained and used to finance exploration into new tranches of claims is alarming, and too often it is not in the claimant’s best interest. Claims farming with litigation funding arrangements backing those claims are having a wide ranging impact on claimants and defendants/insurers alike. Claims surges create burning fires that mean that the response cannot always be strategic.

In new claim types outside of personal injury there is no referral fee ban. Our investigations reveal that a lot these referral fees are wrapped up or disguised as disbursements. They are then regularly subject to recovery from either the litigation funder or from the defendant/insurer when claims are paid. Of course, we have considered above and in other blogs how claims management companies are often closely connected to the law firm.

It is arguably the funder that then has an interest in these cases succeeding, rather than the law firm, so they can see a return on their investment.

This industrialisation of claims is quickly becoming the new norm. We all know the regulatory environment is rapidly changing, with claims being farmed and funded faster than ever before.

Insurance and reinsurance

Insurance and reinsurance

United Kingdom

United Kingdom