In the second installment of our claims farming series we explore the modus operandi. How does claims farming work? Who are the parties involved? What are the behaviours it creates in claims? Who is gaining financially? And what is the impact of the practice?

How does claims farming work?

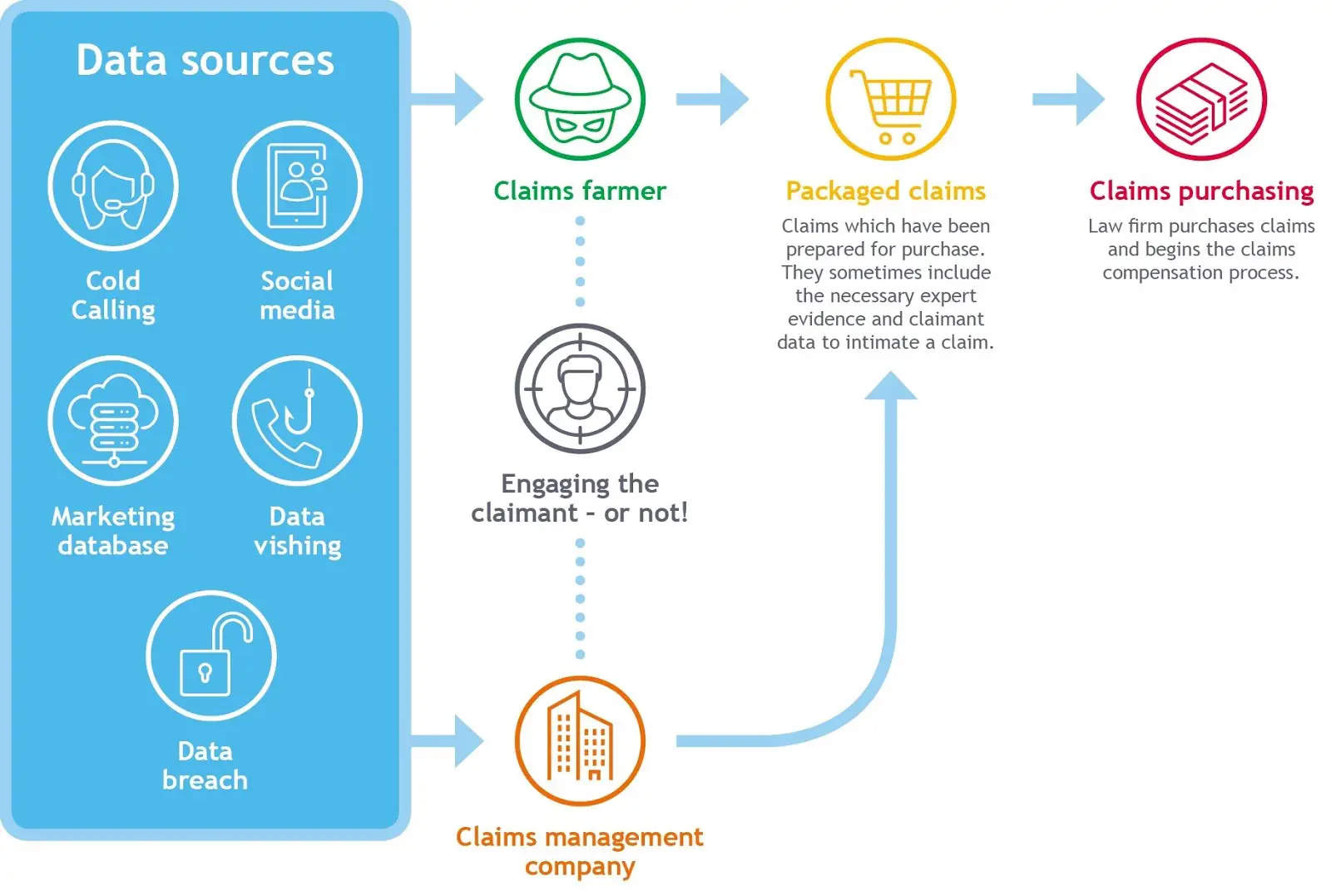

The claims farming cycle

1. It all begins with a data source. The claims farmer or 'lead generator' can obtain the person's details through a marketing database or social media campaign. More questionable sources of leads can be obtained as a result of data leaks or vishing attempts.

|

Lead Generation: “the action or process of identifying and cultivating potential customers for a business's products or services.” (Oxford Dictionary) Vishing: “the fraudulent practice of making phone calls or leaving voice messages purporting to be from reputable companies in order to induce individuals to reveal personal information, such as bank details and credit card numbers.” (Oxford Dictionary) |

2. Now that they have the person’s details, the claims farmer or lead generator will contact the person by way of cold calling, contacting via social media, door to door canvassing or even directly approaching the person whilst on holiday or place of work. They don’t always know the person has been involved in an incident or has a claim, but will give it a go in the hopes that the person reveals that they have. If the person reveals that they have or shows interest in the possibility that they may have a claim, they will continue the engagement to obtain as much information as possible in relation to the event.

In more serious cases, they may not engage the person at all and go ahead and attempt to pursue a claim anyway given that most information required to pursue the claim has been obtained via the data source.

Example: cold calling car accident insurance claim call 1:46

3. The details obtained will then form part of a 'package' which tends to include enough information to complete a CNF or letter of claim, in some cases, it may even contain expert reports.

This package now has everything needed to commence a claim, it just needs to be formally intimated. The claims farmers will sell these packaged claims to their panel of solicitors for a fee. These fees are typically disguised as expert or marketing fees.e that can then be subject of attempted recovery within solicitor costs.

4. These 'packaged' claims often come with pre-arranged, or tied, funding in place. The funding arrangements for solicitors conducting claimant litigation is varied and complex. Genuine claimants suffer. Often law firms become dependant on the referral source or funder. We will be exploring litigation funding in part 3 of our claims farming series.

Where the claimant is awarded compensation the solicitors recover costs from the defendant (or their insurer). In addition there is often a Damages Based Agreement, which deducts additional costs from the damages recovered. There are then further slices from the damages taken by the CMC who will deduct their fees and costs. All too often genuine claimants recover substantially less than the damages agreed.

In unsuccessful claims solicitors may go without their costs, or (where litigation funding is in place) the funders do. Where litigation funding gives the solicitors a 'no-win no-worries' situation with some ‘work in progress’ (the solicitor’s time and effort) funded and disbursements covered.

In other funding arrangements, the litigation funder remains a creditor to the law firm creating business risk. We have seen legal businesses fail when litigation funders call in their debts.

In other unsuccessful claims sometimes claimants can be left owing their solicitors their fees. Claimants, sold on the promise of 'easy compensation' and encouraged that they have a genuine claim that proves to be anything but, can be then tied into litigation that they do not want to pursue on the threat of owing the solicitor significant sums. This is something we are seeing across the industry in cavity wall claims where claimants are advised that they have a claim by CMC 'experts'. These claimants would not have thought to claim without this inducement and encouragement.

Sometimes there is an After The Event Insurance policy that covers claimant and solicitor. However, in the case of a fundamental dishonesty finding, the claimant is left owing the defendant’s costs, and (as mentioned above) often their own solicitor’s fees.

More recently we are seeing claimants required to sign up to litigation loans to fund legal actions.

All too often claimants are encouraged to present claims and offered funding arrangements that are clearly not in the claimants’ best interests and without sufficient (or often any) explanation.

Examples of claims farming related fraudulent behaviour

1. Claimant does not know claim has been made in their name.

We recently investigated claimant 'authorisations' to flight delay CMCs. The electronic signatures on these documents proved to be incapable of substantiation and investigations revealed the claimants being completely unaware of claims being made in their behalf.

In paid claims, claimants reported being contacted with the usual cold-calling script of: “We have compensation waiting for you to collect. All you have to do is sign here…”. Claimants were being asked to sign up with the flight delay companies after the fact.

2. The claimant is encouraged to claim… and lie.

The Mail on Sunday conducted an investigation into travel sickness claims and reported the behaviour of claims farmers abroad. The UK based company operating abroad told the undercover reporter: “Get a doctor’s note, even though he was no longer ill, to triple his payout; Pretend he had reported his ‘illness’ to hotel staff; Falsely claim his food was not heated properly and exaggerate the length of his illness.”

The ambulance that the cowboy firms are touting for business in as they drive around tourist resorts. Source: Mail on Sunday

3. Falsifying evidence and cost layering in order to pursue a claim.

Cost layering is one of the most common (and simplest) methods of inflating a claim that we see and deal with regularly. It occurs on an industrial level across the claims industry. In many occasions dishonest CMCs will falsify documents and evidence to support it.

In a reported case, Accident Claims Assistant Ltd (ACA) who were found guilty of deliberately forging claimant’s signatures and amending documents. Judge Godsmark said: “That a solicitors practice can purport to act for a client they have never met or had direct contact with is startling.

“That those solicitors feel able to commence litigation on behalf of an individual they have never met or had direct contact with, without any funding arrangement in place, is frankly appalling. When I add to that the manner in which the litigation was pursued with falsification of the dates of letters, also to deceive, the picture is deeply disturbing.”

ACA referred cases to Asons Solicitors, who have since been shut down by the SRA. In the disciplinary tribunal hearing of Kamran Akram, principal solicitor at Asons, it was revealed that false claims for special damages were being submitted by the firm.

4. Claims farmer behaviours are not exclusive to one way of operating.

Ruth De Asha highlighted in The claims of wrath: a story of continuing claims migration and farming the complex behaviours and impact of claims farming we have seen in cavity wall claims, including:

- Fictitious claims,

- Individuals who had no idea a claim was made on their behalf,

- Claimants advised (wrongly) in respect of a right to claim and losses,

- Special damages being exaggerated, and

- Claim and cost layering.

These are just some of the fraud behaviours that we see in farmed claims where often claimants are encouraged to bring claims through promises of no-fuss compensation with zero risk and exploited. Without this encouragement these claimants are likely to have never become insurance fraudsters.

Insurance and reinsurance

Insurance and reinsurance