In the previous installments of our series The Future of Fraud, we discussed the industrialisation of claims. In this new series, we will explore the practice of claims farming: what it is, how it works, current examples and future possibilities.

What is claims farming?

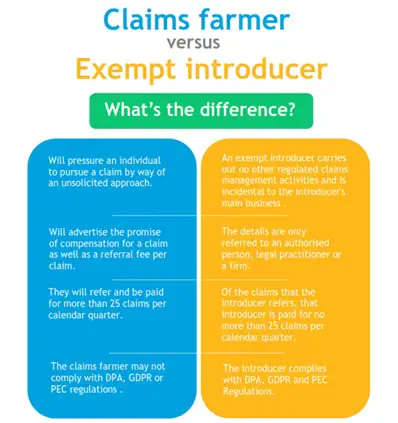

In simple terms, the practice of generating claims for financial gain. The prospective claimant will be contacted and encouraged to pursue a claim. The claimant is enticed by the promise of compensation payments, requiring minimal effort. Claims farmers are synonymous with the behaviour of making unsolicited contact with individuals, even when they have not been involved in an incident or have no interest in pursuing a claim.

Fraud concerns can arise within farmed claims, when the incident has been fabricated, did not occur as alleged, or has been exaggerated in order to maximise compensation. More concerning, are the instances where claims are brought without the knowledge or consent of the claimant, potentially making a fraudster out of them without their knowledge. This non-complicit fraud also happens where claims companies layer claims with additional heads of loss for things that are either not necessary to the claimant or are added entirely without the claimant knowing.

Definition: claims farmer [noun] - a middleman who encourages people to make compensation claims and who then sells these claims on to a lawyer (Collins Dictionary).

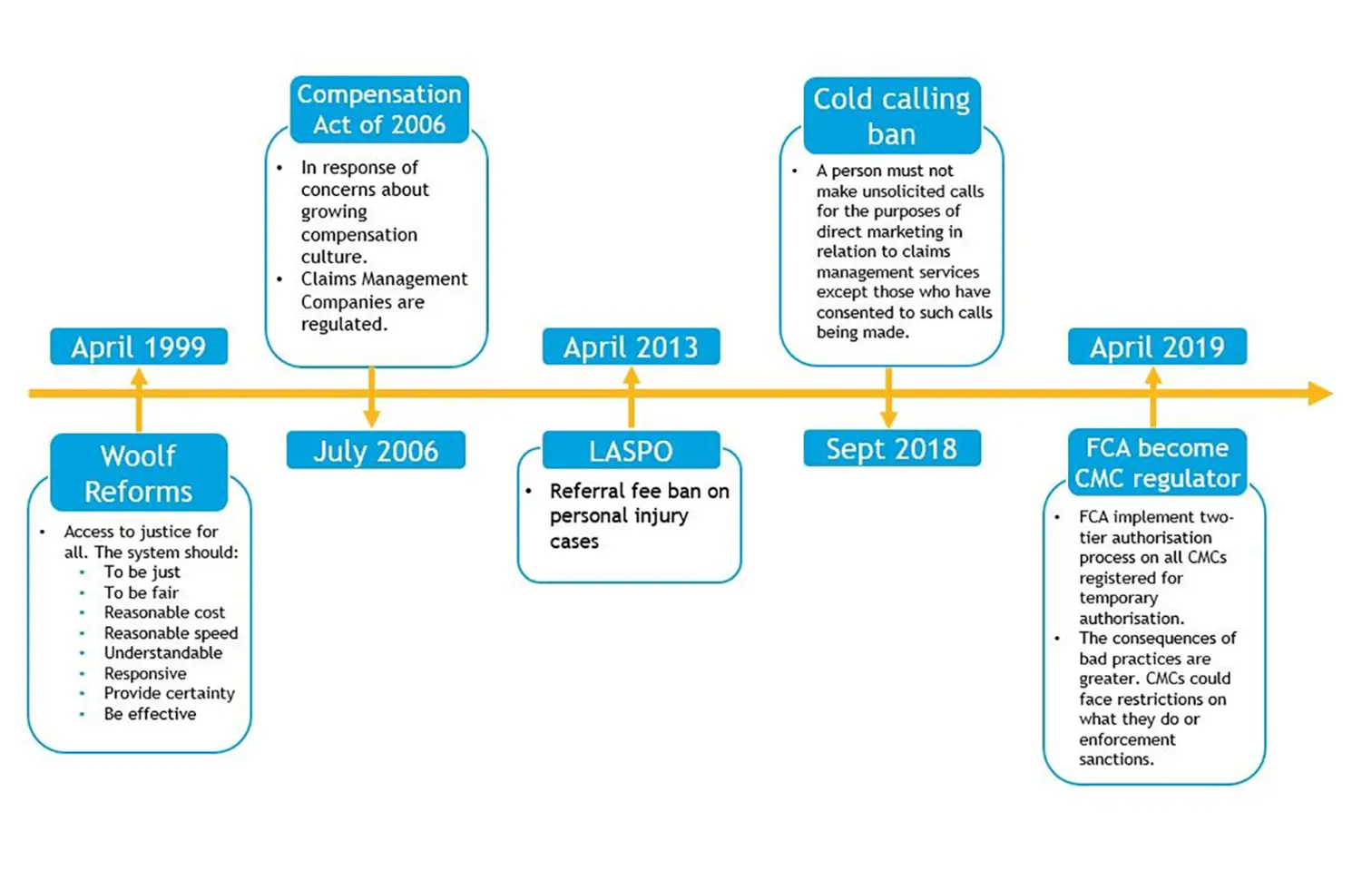

It can be argued that claims farming is an unintended consequence of the Woolf reforms and Access to Justice. These far reaching reforms removed most state backed funding (Legal Aid) for injury compensation claims and sought to maintain access to justice by allowing the private sector to fill the gap through funding arrangements that permitted and incentivised “no-win no-fee”.

Fast forward a few years and what we have is a culture where seeking compensation is almost second nature. Businesses involved in providing claims management services industrialise the generation of referrals to lawyers who pay handsomely for new claims. The public are now used to receiving phone calls stating “Our records show you’ve been involved in an incident”, which has become the new normal along. What is also now the norm is the expectation of a financial reward for every and any small misfortune that life serves up.

There has been a response to claims farming activity. Regulation of claims management companies came with the Compensation Act 2006. This was followed with the ban of referral fees in 2013, By 2014/2015 reporting year nearly a quarter (23%) of all CMCs were facing some sort of regulatory intervention from Claims Management Regulator. To most observers it become clear that there were ongoing issues in the way claims are referred to claimant solicitors.

In 2016 insurers detected 125,000 dishonest claims, worth £1.3 billion to the insurance industry. Even though a referral fee ban on personal injury claims was now in place and claims management companies were regulated, dishonest claims were still an issue. The MoJ published an initial assessment for evidence into whether or not the referral fee ban was effective. FOIL reported that, in their view, it was not; it is hard to disagree. They referenced an SRA survey which revealed 88% of managers in law firms visited by the SRA were aware of firms breaching the ban.

The September 2018 ban on cold calling relating to claims management services requires that a person must not use electronic communications services to make unsolicited calls for the purposes of direct marketing in relation to claims management services.

Those who break the rules could be fined as much as £500,000 by the ICO. Even though this would appear to be a deterrent to claims farming related activities, there remains the exception that individuals can consent to receive direct marketing calls.

In April 2019 the Claims Management Regulator ceased to regulate Claims management companies, the responsibility now falling to the FCA who are implementing a two-tier authorisation process on all claims management companies registered for temporary authorisation. The consequences of bad practices are greater for these companies who, if identified to be breaching regulations, could face restrictions on what they do or enforcement sanctions.

What is clear is that even though referral fees have been banned in personal injury claims; and cold calling has been banned (although practically only to an extent), the practice of receiving unsolicited approaches to claim and paying an intermediary for a claim, still goes on. The FCA’s takeover of claims management regulated activities is still in its infancy and enforcement for those breaching regulations is yet to be seen,. However, in the short time they have been regulating this industry, the FCA has already criticised advertising standards of claims management companies, saying:

CMCs using misleading, unclear and unfair advertising practices to get business is completely unacceptable. We won’t hesitate to take action where we consider that customers are being misled or otherwise treated unfairly by poor advertising.

Whilst different initiatives have been implemented, there remains an ever present danger from claims farming. Principally, there are still many types of claims that remain unregulated where referral fees are permitted. Pressure on the personal injury sector have pushed CMCs into new sectors which they look to exploit using their tried and tested methods to maximise claims activity.

Identifying, and predicting, these is part of the challenge before all compensators. As a consequence, having robust validation processes will ensure that claims farming activities are minimised.

However, more needs to be done in respect to ensuring both the legislation and regulation relating to the claims industry is protecting society, the insurance sector and other industries from the negative aspects of claims farmer activity, including ensuring there is sufficient protection from fraudulent claims.

In this series...

Claims farming part 2: modus operandi

Insurance and reinsurance

Insurance and reinsurance